Since 2008, I’ve been using website brokers, marketplaces, and Facebook groups to buy content website assets.

However, they all have their own processes, requirements, asset value minimums, among a plethora of other factors. In this write-up, I provide a detailed run-down of my recommended places to find websites for sale, along with their pros and cons.

If you are looking for my most recommended broker for both sellers & buyers, check out Empire Flippers below:

BATTLE-TESTED RECOMMENDATIONS

Empire Flippers – Market Leading Brokerage

If you are looking to buy or sell a content website, e-commerce, Amazon FBA, SaaS, or any other online business, Empire Flippers is highly recommended.

I was an early buyer on their platform when they first launched and have actively bought and sold many websites from them. They have a top-notch team that will help you through the entire process.

Best Website Brokers and Marketplaces: My Recommendations

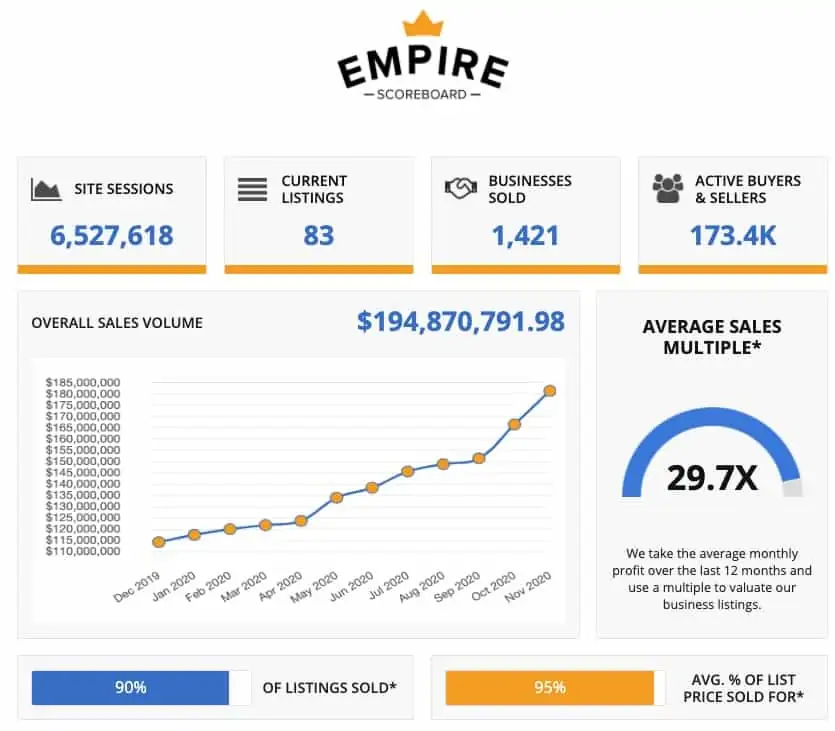

Empire Flippers: Largest Vetted Broker

Empire Flippers is by far the largest vetted private marketplace. They do preliminary vetting of each deal to ensure the traffic, P&L, seller intent, among other things is correct. You still need to vet the deal to match your criteria.

Most of their deal flow is $100,000 plus nowadays and they list content sites, e-commerce, and SaaS business.

Empire Flippers sends out assets for sale every Monday morning at 10 AM USA Pacific Standard Time (PST). You must sign up on their website to receive access to these emails.

They also publish excellent quarterly reports summarizing their business and the industry overall. A must-read!

My Review

I was an early buyer on Empire Flipper’s platform when it first launched. During that time, they regularly sold sites for less than $50,000.

I’ve both purchased and sold websites via Empire Flippers. Their team is top-notch and understands what they are doing. If you buy a site, they will help migrate the site to your hosting so it’s hands-off for you.

Overall, a great experience.

Pros:

- Vetted deal flow

- Deals are not made public unless proof of funds is shown

- The buyer gets a due diligence period to verify assets

Cons:

- For buyers with large budgets. They do not have any lower-valued deal flow

- A ton of demand. Good sites sell immediately after going live

- High valuations typically above market averages

- 15% broker fees charged to the seller which can cause inflation of valuations to cover fees

Sites for Sale on Empire Flippers Marketplace

Here is a selection of the recent sites that are available for sale:

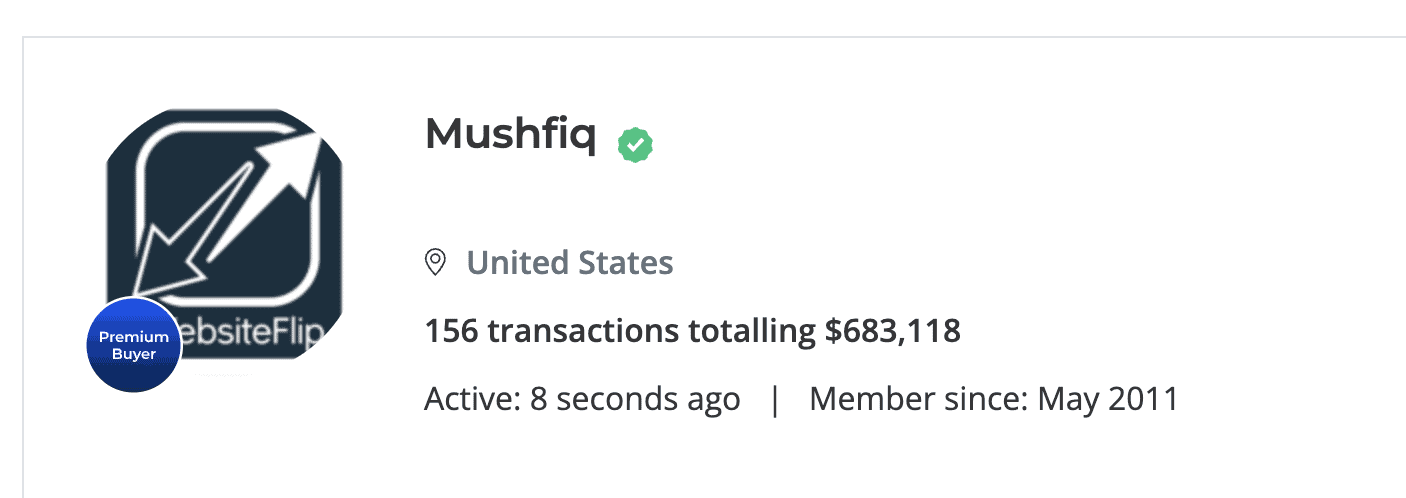

Flippa: Largest Non-Vetted Marketplace

The largest marketplace of websites available for sale is Flippa. The listings are not vetted so you must verify everything. Deals can range up to 7 figures.

I’ve done 156 transactions on Flippa to date and it has been the source of both my case study sites in the outdoor and dating niches. I’ve been transacting on Flippa since 2010 with 100% positive feedback.

Check out my in-depth Flippa review.

3 Steps to Find Deals on Flippa

These are tips that have worked for me since 2010 on Flippa.

1. Filter by investment criteria

Once you know your investment criteria, you can create filters and then subscribe to them to be auto-notified when a listing goes live that meets the criteria.

For example, visit the Flippa Content site page, and then choose the filters accordingly. The filters available to you include:

- Keyword

- Asset and Website Type

- Industry

- Age

- Monthly traffic

Of course, the more strict you make these, the less dealflow available and vice-versa. Once you’ve honed down the criteria, you can subscribe to alerts to get auto-notified.

2. Check Frequently

Once you’ve figured out the filters from above, bookmark the URL and check regularly.

Listings go live all the time but alerts have delays. You want to have first eyes on all deal flow that meets your criteria.

3. Act Quickly

Flippa is an open marketplace. You have access to the same deal flow that I do. Active buyers will pounce at quality sites. So you have to act quickly.

Do your due diligence and engage in a private discussion with the buyer to discuss a buyout.

Pros:

- Access to significant deal flow

- Asset size can range from any size up to 7-figures

- Access to content, e-commerce, SaaS, domains, and mobile apps for sale

- Partnered with Escrow.com to facilitate a safe environment post-purchase to do the transfer

- Sellers are all verified via identity checks

- Websites for sale are verified to be in ownership of the seller

Cons:

- Many low-quality (sometimes misleading) listings: you have to know how to weed them out. Buyer beware of Flippa scams!

- No basic vetting of website data, P&Ls, etc. It’s all up to you to verify.

- Flippa auctions can get out of hand in terms of people bidding the price up above market valuations

Make sure to also read my article on Empire Flippers vs Flippa, where I compare and contrast different categories (e.g., marketplace size, fees, vetting, and more).

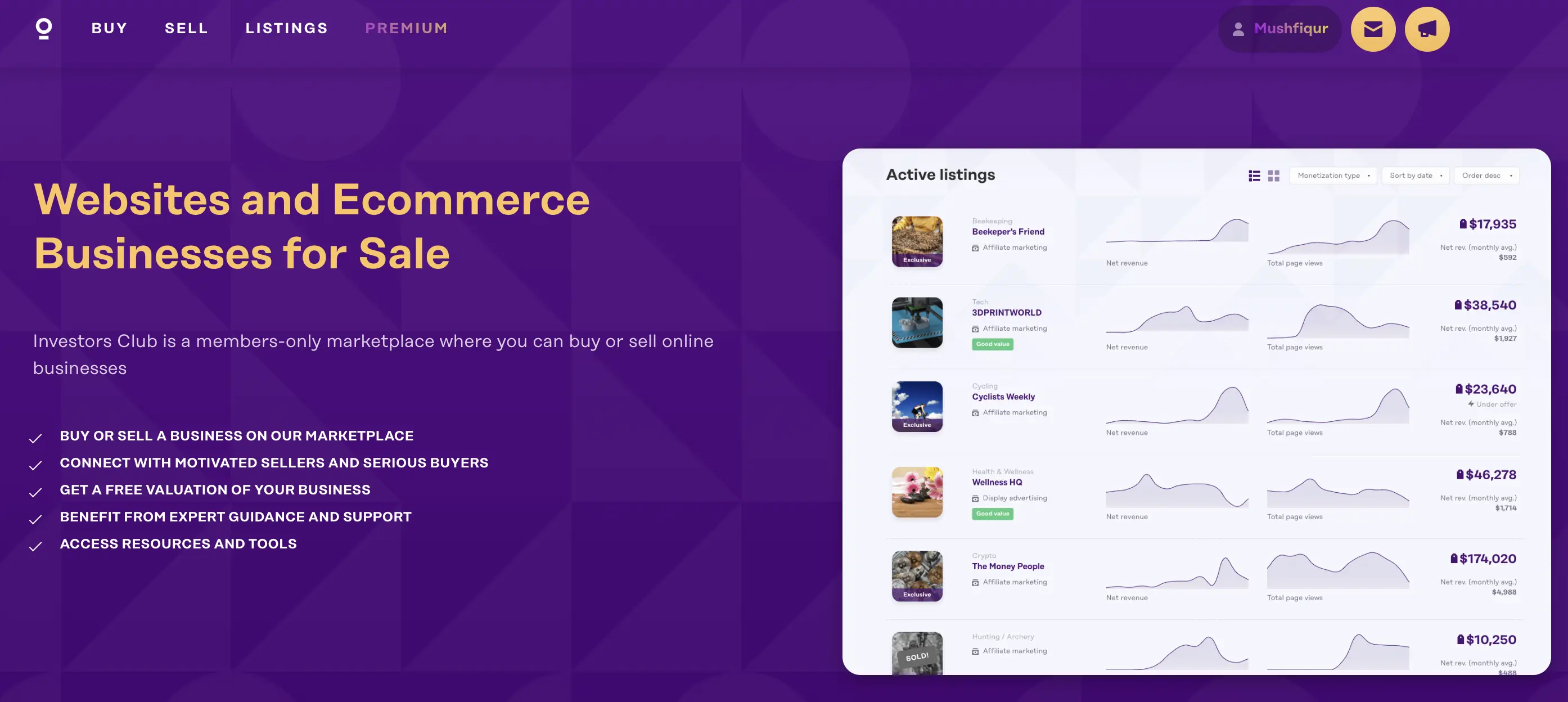

Investors Club: Membership-based Deals Marketplace

This is a new marketplace that started up in 2020 with vetted deal flow. Their model is unique.

They charge the seller 5% broker fees (compared to Empire Flippers at 15%, and Flippa at less than 10%). They also charge the buyer a membership fee to have access to the dealflow and due diligence reports.

My Review

I’ve purchased two websites in 2020 from Investors Club priced at $22,000. I found the deal through their platform, communicated with the seller, and closed the deal via Escrow.com.

Investors Club provides access to quality deal flow. They also provide full website migration, and a no-fee Escrow service to manage funds during due diligence if that’s desired. Furthermore, their Deal Concierge services provide help with deal negotiation and also finding/sourcing private deals based on your investment criteria.

They are a pure marketplace to connect the buyer and seller directly.

As a seasoned investor, I appreciate that I can negotiate directly with the seller and handle things my way. For newcomers, using their in-house white-glove services will be a must.

Read my in-depth Investors Club review.

Pros:

- Dedicated marketplace for content websites

- Detailed due diligence reports provided for members

- Ability to negotiate with the seller

- Excellent dashboard with business metrics

- Fair market valuations

Cons:

- Buyers have to pay a hefty membership fee to get immediate access to deals

Sites for Sale on Investors Club Marketplace

Here is a selection of the recent sites that are available for sale:

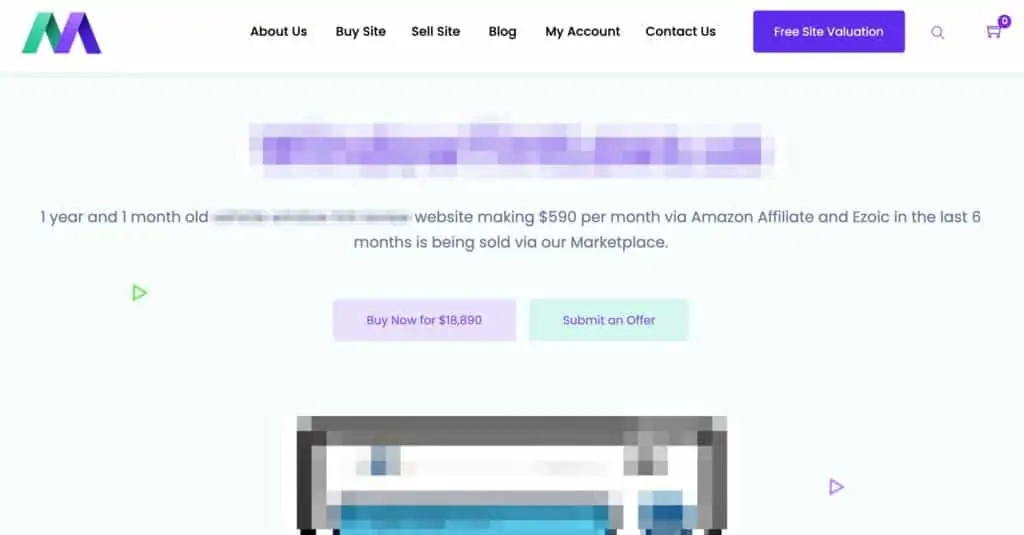

Motion Invest: Website Marketplace

If you are looking for quality content sites sub-$30,000, Motion Invest wins. Check out the more detailed write-up about Motion Invest along with an analysis of past deals that have sold.

They are structured as a dutch-auction marketplace. In their own words:

This listing is doing a Dutch auction which means, the price on the site is lowered $275 every 2 days, until it gets a bid or it hits the reserve price. The first bid made is the winning bid and will get the site.

Motion Invest

This is a unique model as it allows website listings to meet at the equilibrium price over time. One caveat with this is that some buyers may tend to “wait it out” to see if the price drops until they pull the trigger on buying the asset.

My Personal experience: I personally have vetted many of their websites for potential acquisitions, however, have not purchased any sites from them (nor listed any for sale). I know the owner, Spencer Haws, and I know he runs a tight ship.

Pros:

- Access to lower-priced content sites. Beginner-friendly asset prices to get started.

- Fair valuations based on the market

- Due-diligence reports from SEMRush, Google Analytics, earnings screenshots, and SiteBuddy.io reports if an Amazon monetized website

Cons:

- Website URLs are open to all members. May cause copycats for the new buyer of the site.

- Some large sites built on expired domains have experienced large traffic declines

- They sell many starter sites which have little or no earnings and traffic

- Some sites are built by non-native English speakers and the content is poorly written

Sites for Sale on Motion Invest Marketplace

Here is a selection of the recent sites that are available for sale:

The Website Flip Brokerage: Highly-Vetted Deals

The Website Flip runs a boutique content-site brokerage. The brokerage sells sites primarily via their newsletter to subscribers. You must be an email subscriber to get access to deal flow. This allows the site to remain relatively private (thus fewer copycats) and allows for a quicker close with serious buyers.

Pros:

- Primarily sells sites less than $50,000

- Deals are vetted by reviewing earnings, traffic, SEO, and more

- Each deal has highlights, setbacks, and easy wins listed out

- Fair website valuations around 32-38x monthly multiple

Cons:

- Minimal deal flow as they are growing

- Deals shared only through the newsletter

Subscribe to get access to sites for sale:

Join our buyer list to get access to websites for sale!

We send out websites for sale every Wednesday 9AM CST. Join now!

Other Brokers for Mid-Market Assets

The above brokers and marketplaces have more or less beginner-friendly asset values (i.e., sub $100,000). If you are looking for high-revenue businesses, then the following brokers will be your best bet.

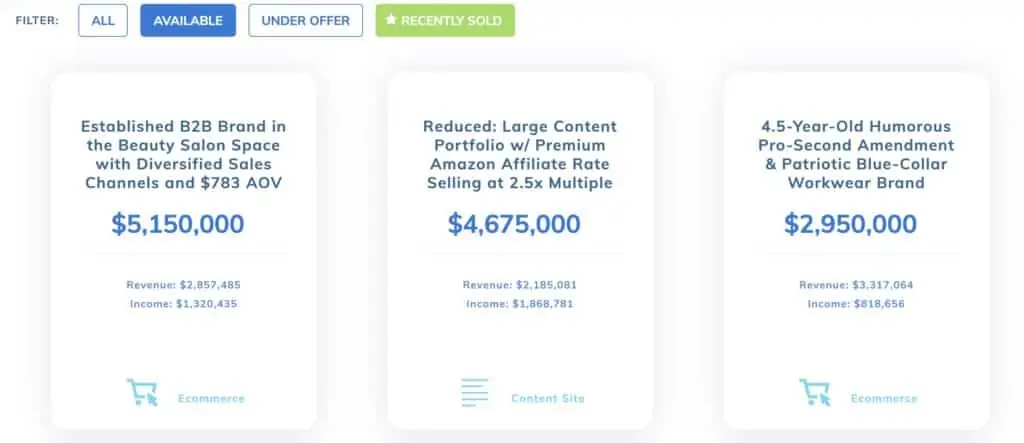

FE International

FE International is also a well-known and respected broker in the online business space since 2010. They provide mid-market businesses for sale (think $1M plus at the very least).

The FE International team has a combined experience of 50+ years in the industry. They have offices in the US (NY, SF, Miami) and Europe (London). Throughout the years, they’ve won several awards. For example in 2015-2016, they were awarded the Deal Maker of The Year from International Business Brokers Association (IBBA). They are also a two-time Inc. 5000 company, an excellent feat in and of itself.

FE International specializes in brokering e-commerce, content, and SaaS businesses. They have a success rate of 94.1% of selling your business, according to their website.

Sites for Sale on FE International

Here is a selection of the recent sites that are available for sale:

Latona’s – Boutique M&A Brokerage

Latona’s is a boutique mergers and acquisitions broker helping people buy and sell cash flow positive internet businesses and digital assets for a healthy multiple. This includes content websites, eCommerce stores, SaaS apps & Amazon FBAs.

Latona’s brokerage was founded in 2008 with offices located in Peurto Rico. They close deals in the 5 to 8 figures regularly through their platform. Latona’s also has a founder-first mentality; each broker has had experience running their own businesses at some point. They understand founders.

Latona’s focuses on brokering content, e-commerce, lead generation, Amazon FBA, and SaaS businesses. Interestingly, they also help sell domain portfolios, which is unique to this business brokerage.

Quiet Light Brokerage

Quiet Light was founded in 2006. Since then they’ve transacted on over 600 transactions valued at $300,00,000.

Their assets are valued at above 7 figures ($1M or more). If you are an active buyer on their platform, you get access to a dedicated broker manager that will help you through the process of finding a business that fits your criteria.

Side note: Their podcast on online businesses is a must listen. Check it out here.

Sites for Sale on Quiet Light

Here is a selection of the recent sites that are available for sale:

Facebook Groups to Find Websites for Sale

The best deals are to be had via private transactions one-to-one with the original owner; no broker involved. This gives you the best leverage plus the seller does not pay broker fees so they are willing to cut you a better deal.

There are a few prominent Facebook groups with deals being posted for sale on a daily basis. However, before sharing those, there are some pros and cons that need to be stated.

Cons

- There is no one to look out for you. It’s the wild west. You will negotiate with the seller directly. If you come to an agreement, make sure to use a Escrow service. I recommend Escrow.com

- Sellers may ask for proof of funds. Take a screenshot of your funds (redact your personal information) and share

- Deals vary in quality from starter sites with no traffic to sites valued over $100,000

- No feedback system (which Flippa has). You do not know if who you are dealing with is legit. Buyer beware.

- All due diligence is on the buyer; no reports provided

Pros

- No broker fees may result in a better deal for the buyer

- Direct relationships with creators of websites leading to future deals

Recommend groups

- Niche Website Flippers: A group with over 11,000 members. This is a dedicated group to post your websites for sale. This is powered by The Website Flip team.

- Flipping Websites: With over 21,500 members and managed by Investors Club, this is the biggest private group for selling online businesses. All listed businesses earn less than $500/mo over the last 6-months. Anything above that threshold must be listed on Investors.club. This is the rule enforced by the admins.

You will find a handful of other groups on Facebook, however, they are mostly ridden with spam posts. The above two are highly recommended as I use them on a daily basis.

Other Non-Traditional Methods

There are other out-of-the-box approaches to finding deals for sale.

Newsletters

Here are my favorite newsletters that send out dealflow:

- Joe Burril: One of the most successful website brokers on Flippa, Joe has a mailing list where he sends out deals.

Manual Outreach

If you know which niche you are interested in, search for specific keywords in Google, and outreach to websites on pages 2-4 of Google.

Many times these are neglected sites that get traffic but just have not been optimized to reach page 1. You can pick up these sites for a relatively good offer if the owner is willing to sell.

Honorable Mentions

Here are a few other marketplaces. They either are up and coming or do not have enough deal flow but are still worthy of mention.

- DotMarket: a marketplace for websites in French

- Website Closers: 20+ years in the business brokering deals in the range of $50,000 and above

- MicroAcquire: excellent marketplace with mostly SaaS businesses for sale

Common Questions about Website Brokers

What does a website broker provide to a buyer?

Proper website brokers provide a first-level collection of metrics, website details, and due diligence. Here is what a good broker will do for each list for sale: (1) Collect profit and loss data, (2) Collected proof of earnings screenshot, (3) Interview the seller, (4) Provide their thoughts for future growth opportunities, and (5) Relay your offer to the seller.

Remember a broker’s obligation is to the seller; not the buyer.

Do I need a broker to find deal flow?

No. You can find off-market deal flow through Facebook groups, Flippa auctions, newsletters, etc. Unlike real estate where realtors have a stronghold on listing on the public Multiple Listing Service (MLS), in the website investing world, there are many methods sellers can use to find buyers.

You can also utilize Deal Concierge services by WebOperators, where they will find websites based on your investment criteria.

Who is the best website broker in the industry?

No broker is the best. Each of them have their pros and cons as covered in this article.

Remember that website sellers have exclusivity agreements with a specific broker and thus the same site cannot be listed multiple locations. This means as savvy website buyers, it’s in your best interest to keep tabs on all of them.

What do website brokers charge?

Website brokers typically charge a commission fee or “success fee” based on a percentage of the final sale price of the website. The commission fee percentage typically ranges from 10-20% based on the broker and the price of the website. Brokers typically charge a lower percentage for sites priced above a certain amount (e.g., Empire Flippers charges a lower percentage fee for sites over $700,000).

Which brokerage can handle the entire process on the seller’s behalf?

Empire Flippers, FE International, and Quiet Light Brokerage all will handle the entire process of selling a website.

This includes putting together the listing description, finding a buyer, helping with Escrow, migrating the website, and ensuring the website is operational.

How can I sell a starter site?

Any site that is not earning any revenue or is earning less than $50/mo will not get accepted by any website brokerage.

To sell such a site, you would need to find a buyer yourself or list in Facebook groups, such as Website Flipping – Buy & Sell Websites.

It’s free to post in groups but you have to sort out the interested buyers and do all of the legwork.

📊 DealFeed.io – Live Analysis of Content Sites For Sale

From this article, you can tell there are a large number of brokers for content websites. With that, at any given time, there are 100+ deals for sale on the public markets.

Below is live data as of today, April 25, 2024 for content sites for sale right now at each major website brokerage. The data is obtained via DealFeed.io, a discovery tool to find content sites for sale.

The tool pulls in all the relevant data for each business for sale, such as description, title, revenue, profit, multiple, niche, and more. This saves you time comparing and contrasting deals across the board to find your next acquisition.

BATTLE-TESTED RECOMMENDATIONS

Empire Flippers – Market Leading Brokerage

If you are looking to buy or sell a content website, e-commerce, Amazon FBA, SaaS, or any other online business, Empire Flippers is highly recommended.

I was an early buyer on their platform when they first launched and have actively bought and sold many websites from them. They have a top-notch team that will help you through the entire process.

Wrap Up

Buying a content website from a broker, marketplace, group, newsletter, or direct can be a good experience if you are working with the best. I listed out my recommendations based on my personal experiences with the team and/or directly being involved in deals.

Here’s a website broker comparison table for the TL;DR crowd:

If you are buying an asset, make sure to do your research and that you understand the associated risks.