Every investment has a lifecycle from acquisition to exit. It’s no different for a digital website asset. However, the specific stages within the lifestyle will be different for a website versus other asset classes.

In this guide, I am going to cover the 5 stages of a website flip’s lifecycle, and then apply the stages to my two active case study sites.

Let’s get into it!

🔄 The Lifecycle of a Website Flip

The 5 stages within a website’s lifecycle are:

- Acquisition

- Stabilization

- Growth

- Optimization

- Exit

1️⃣ Stage 1: Acquisition

In this part of the lifecycle, you are finding opportunities for your next acquisition.

As investors, we are sifting through deal flow from brokerages or doing outreach. The idea is to find that needle in the haystack deal that you want to buy, grow, and flip. A deal can be defined in many ways: (1) under-monetized and under-optimized, (2) easy niche, (3) under-valued deal, or ideally a combination of all.

When acquiring, the end-goal of the exit should be clear. I always keep the following in the back of my mind:

- Timeline: When would I want to exit (or initiate the next steps with the site)?

- Monetary: What’s the revenue target for this site within the time period of exit?

- Strategy: What’s the exit strategy?

Note that an exit is not always a full sale. It can also be seen as positioning the site to be taken over by a team of VAs, hiring a website operator, or selling off majority equity to take “chips off the table”. This will free up your time and provide a cash influx for your next project.

Takeaway: Before building or acquiring, keep an idea of the Timeline, Monetary, and Strategic goals for an exit.

2️⃣ Stage 2: Stabilization (2-4 weeks)

There is a time period post-acquisition where the site needs to be stabilized. A change in ownership means a change in processes and structure.

Immediately after purchasing a site, I spend a few weeks fixing the site. This includes:

- Changing the theme (if needed)

- Removing and adding plugins

- Improving site speed

- Improving site structure

- Switching out affiliate tags

The site is going through many simultaneous changes during this time period.

This stage is analogous to fixing the foundation on a real estate property. Without a proper foundation, it does not matter what other improvements you do.

Takeaways: Take a few weeks to stabilize the site, improve the foundation, and monitor earnings and traffic. A strong foundation is key to future growth.

3️⃣ Stage 3: Growth (3-9 months)

This is the stage where you are investing heavily in the site. The bulk of the work will be at this stage.

Growth for typical content-based sites can be a combination of a few or all of these:

- Optimizing existing content for better on-page SEO

- Adding new content targeting low-competition keywords

- Optimizing for conversion with CRO techniques

- Adding new revenue sources

- Adding new traffic sources

- Adding backlinks

- Improving overall site on-page SEO

I apply all of these techniques above simultaneously across the 3-9 months of the growth phase. The compounding effect is strong with websites.

Takeaways: Fuel the growth of your website with a combination of different easy wins. I cover 120+ more strategies in my EasyWins.io database that you can check out.

4️⃣ Stage 4: Exit Optimization (3-6 months)

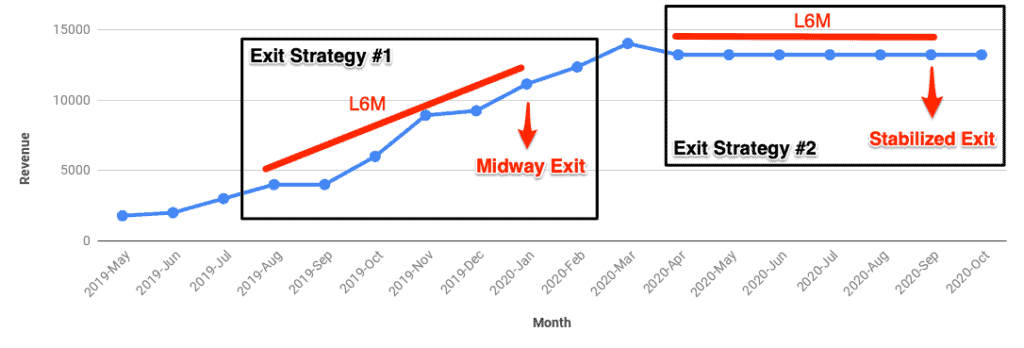

The website industry values a website with the last 6-month (L6M) of average earnings (unless it’s a seasonal site which then resorts to a last-12 month average).

After the Stage 3 growth phase, you need to give the site time to showcase that growth over the last 6-months.

Two strategies that I take are:

- Exit midway on the growth curve

- Wait for the growth curve to stabilize

Graphically, this can be visualized as follows:

For a quick exit, exiting midway is the best option. This is because the buyer sees the month over month growth and knows that if they buy now, the site will continue on the upward trajectory. They are buying in at a lower L6M average.

The cons of this are that you are not getting the maximum sale price since the L6M is lower.

For a fair exit, wait for the growth curve to stabilize over 6-months.

Takeaways: Make sure to understand when you want to exit and optimize for that.

5️⃣ Stage 5: Exit Execution

This is the fun part. Your months (sometimes years) of effort is about to pay off.

Either you are planning for a full exit by selling through a marketplace, finding an operator, or hiring VAs to do the day-to-day tasks.

A full sale can take time and there are sweet spots for most buyers:

- < $10K: Large buyer pool. Sites can be sold within 48 hours.

- < $50K: Large buyer pool. Sites can be sold within 1-2 weeks.

- < $200K: Sophisticated medium-size buyer pool. Sites can take 3+ weeks to sell.

- > $200K: Very sophisticated small-size buyer pool. Think funds, group buys, etc. Sites can take 4+ weeks to sell.

Note: these are just estimates. Your mileage will vary on who you are dealing with.

In all these cases, we are assuming the site is high-quality, on a good trend, and has good fundamentals.

Takeaways: The “exit” here is to reduce your time commitment to the business so you can move on to the next venture with the cash influx.

Case Study #1: Lifecycle of the Outdoor Site

Update: as of March 2022, we sold this website for $175,000 through our newsletter to a private buyer. The website generated $100,938 in revenue during ownership and we spent $37,582 to grow it. Our total profit considering the acquisition cost was $238,356.

As of Q4 2020, my outdoor site was going through this lifecycle. Here are the case studies if you want to read up on them.

Let’s break down the lifecycle for this site graphically:

Explanations:

- Acquisition: purchased March 16, 2020

- Stabilization: changed the theme, fixed affiliate links, improved site structure, improved page speed, etc. This was done from March 16 to April 30, 2020.

- Growth: over 200+ articles added, 10 monetization methods added, email marketing push, and more. This was done from May 2020 to November 2020. The site is in this stage now.

- Exit Optimization: this stage will arrive in Q1 2021 where I will only do fine-tune tweaks and await for the site to stabilize in earnings.

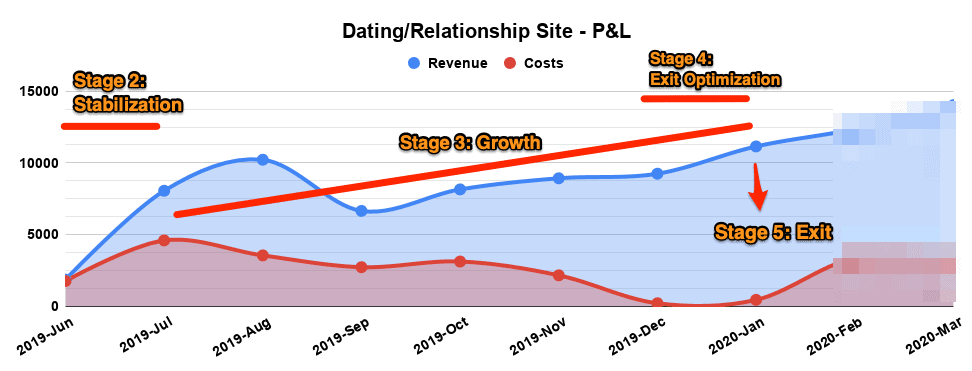

Case Study #2: Lifecycle of the Dating Site

This website was sold in January 2020 and I currently manage it as the operator. Check out the most recent case study update. Generally speaking, I am always looking to remove myself after the flip, but this one specifically still had an upside remaining and thus I remained as the operator and kept some equity.

The lifecycle can be analyzed graphically as follows:

Explanations:

- Acquisition: purchased April 30, 2019

- Stabilization: Fixed affiliate links, improved site structure, improved page speed, etc. This was done from May to June 2019.

- Growth: over 100+ articles added, 5 new monetization methods added, on-page optimizations, and more. This was done from June 2019 to December 2019.

- Exit Optimization: As stated above, you can exit midway on the growth curve or wait to stabilize. I decided to exit midway in January 2020 as growth was ramping up.

- Exit Execution: The exit happened in January 2020. I sold off 75% of my equity and kept 25% of equity. I then continue to operate the site for a fixed monthly fee and profit share.

Next Steps…❓

How does this apply to you? Take the 6 lifecycle stages of a website and apply them to all of your websites.

Each website in your portfolio should have a purpose. Hedge funds sell off their portfolio, add-on, and optimize on an ongoing basis. Treat your portfolio like you are managing a hedge fund; it’s no different.

Ask yourself these questions:

- Which stage of the lifecycle is my website at?

- What is my exit strategy? If you are holding long-term, define a plan anyway in case you do not want to manage it in the future.

Understanding a website flip lifecycle can provide structure to your investment decisions. I utilize this lifecycle on every project I get involved in regardless of size.