2023 Update: A lot has changed in terms of companies doing website funds. I note the funds that are now not operational.

Disclaimer: This write-up is based on my experience, opinions, and research. You should consult your own financial and legal experts before making any investment decision.

Website Investment Funds have been sporadically appearing since early 2020. As this asset class matures, it’s natural for those who understand the website operations process to create investment funds.

This write-up will cover all you need to know website investment funds. The topics covered include:

- Why invest? Who should invest?

- Vetting Fund Operators

- Red Flags

- Best Website Investment Fund

What is a Website Fund?

I will put it in layman’s terms. An investment fund is when a company raises money from partners (you and I) to execute on a pre-determined strategy over the course of a time frame (usually years).

A website investment fund is solely focused on buying websites, or other such digital assets (SaaS, Amazon FBA, among others).

This article will not go into how a fund is set up. For that, there are excellent resources such as here and here. You can also check out my free website portfolio financial model, which models out a fund’s operations.

Why Invest in a Website Fund? 4 Reasons

There are a handful of reasons why an investor may invest in a fund. Here are the ones that resonate with me:

1. Passive Income

In general, investing in a fund is as passive as it gets. You give someone else your money and they do the rest. Specifically, in the digital business space, where it can be time-consuming and emotionally taxing at times to manage the assets yourself, a fund sounds like a great way to get the high-returns (albeit lower than a DIY approach) in a passive manner.

2. Diversification from conventional investments

If you are heavily reliant on real estate, stocks, or other conventional investments, investing in a website fund can provide the necessary diversity.

Digital assets are relatively uncorrelated with the stock or real estate markets in terms of day-to-day operations. However, there is a correlation of the stock market to website buying/selling in terms of cash available for individuals/companies to deploy money into digital assets.

3. Diversification of other digital asset classes

Chances are if you are reading this write-up, you are already active buying websites or building them. You may already have your funds tied into your own digital assets.

Each investment fund has a thesis of what they will invest in. There are funds solely focused on content websites, Amazon FBA, SaaS, among others.

If you are highly invested into content websites, it makes senses to invest in a e-commerce fund to get that exposure. The only other alternative is to DIY your own e-commerce business but that takes away from your current ventures.

4. High returns

Website funds should be providing higher returns than, for example, your traditional real estate fund. This is because websites generate significant cash flow as a function of their acquisition cost (i.e., assets can bought at 30-35x multiple of monthly revenues) and have many “levers” to grow.

Who Should Invest in a Fund?

Most funds are only open to accredited investors, which is defined as an individual with more than $200,000 or $300,000 income with a spouse in your two most recent years, or net worth of $1M excluding primary home’s value.

Accreditation status is a way for the U.S. Security Exchanges Commission (SEC) to limit who can invest understanding that those with money (high net worth individuals) can afford to take the risk in non-traditional investments.

Investors who are experienced solo-operators

Being a solo-operator gives you insights into how to operate website assets. You know the ballpark estimates of what the cost of goods should be to run a website (i.e., content costs, virtual assistant costs). This gives you an insider edge to pick the right fund with the right operating model.

Investors who understand digital assets and risk profiles

Digital assets are a relatively new asset class that is now opening up to the masses. If you are an investor who has never operated a online business, but have funds to deploy, I encourage you to first learn how they work and their risk profile.

The risk profile of an online business is extensive, such as Google algorithm updates, social media algorithm updates, Amazon commission cuts, brands changing commission structures (I lost $1,000/mo recurring commissions after a brand change its rules), among a plethora of other factors.

Make sure to understand what you are getting into.

How To Vet Fund Operators: My Recommendations

Vetting a fund’s operator is the same as vetting a website operator. Most fund operators start as a “family office” managing money for friends and family, and then level-up to build a fund.

Here are high-level aspects to vet.

Track record

In the website space, vetting a track record is simple. Ask the fund to provide you with their past deals, how they grew the businesses, and what they exited the businesses for.

Don’t just ask for their successes. Ask them for their failures. In this game, failures will happen due to the risk profile. What’s important to understand is the following:

- Why did the operator choose to acquire that asset?

- How did they grow it while it was performing?

- What internal or external situations caused the asset to fail?

- How was the situation remedied for investors?

- What are they doing to protect the fund from this happening again?

I am happy to give my money to a fund operator who can succintly answer these questions. I want my fund manager to accept their failures, grow from it, and have a plan in place to make sure that risk is minimized.

Experienced team

The difference between a website operator acquiring a site or two for an investor, and a fund acquiring several sites for several (maybe hundreds of) investors is scale.

A fund must bring on a team, and at times, hire a new team to manage the fund’s new acquisitions. They should have a core team in place prior to the fund launching.

It’s on you, as the investor, to read up on the core team. Research their name, what they’ve done in the past, and ask around the same social circles (tip: most website operators can be found in various Facebook groups).

Website Ops -> Fund Ops

Most fund managers are leveling-up from being “family office” website operators. Apart from the legalities, the day-to-day process of running a portfolio of sites is not much different than running a portfolio of sites for a fund.

The differences lie in the sheer scale. An operator may run a portfolio of sites acquired under $100,000 which are then scaled and then sold. However, for a fund sized at $1M, the manager needs to acquire 4-5 sites around the $250,000 range. The scale can be larger than an operator is used to.

As an investor, the questions to ask are as follows:

- How is the manager structuring their team?

- How are they protecting the downside risk of a large asset failing?

- What is their diversification strategy within the fund?

- How many assets will they purchase?

- What multiples will they target when buying?

6 Typical Red Flags in Funds

There are many horror stories of funds gone bad (e.g., the Income Store debacle). Make sure to do your due diligence, ask the right questions, review every document, and understand what you are getting into.

Here are are a selection of red flags to take into consideration.

1. Poor legal framework

Investment funds need to be properly incorporated and abide by all U.S. SEC laws. While real estate syndications/funds have been around for decades, website investment funds are new. Make sure to review the legal documents to ensure it makes sense.

2. Fund has no or not enough “skin in the game”

Your fund manager MUST put in capital. Otherwise, they are not motivated to the same degree as you are. Without their own capital, they can walk away anytime since they are then not a “partner” but an “employee” that’s being hired to manage the fund’s assets. Make sure your incentives are aligned.

For example, in a real state fund that I participated in, the fund put in 6.7% of the required capital.

3. Not enough returns

Websites are high-risk but generate high cash flow as a function of initial acquisition cost. Such a structure should garner a high return.

Real estate syndications receive 8% returns annually. If you are not getting much higher returns than that, I see no point in participating in a website fund.

4. Not enough earmarked growth capital

A seasoned operator knows that each asset requires upfront growth capital from day one. While the cashflow from the asset can help fuel growth, there is a 30-60 day wait on these funds to actually reach the bank account. What happens during that time?

A fund should earmark a percentage of the fund to be for initial growth capital. For a $1M fund, this should be at least $30,000 or around 3-5% max. This is enough capital to inject into new content, software, employees, among other factors.

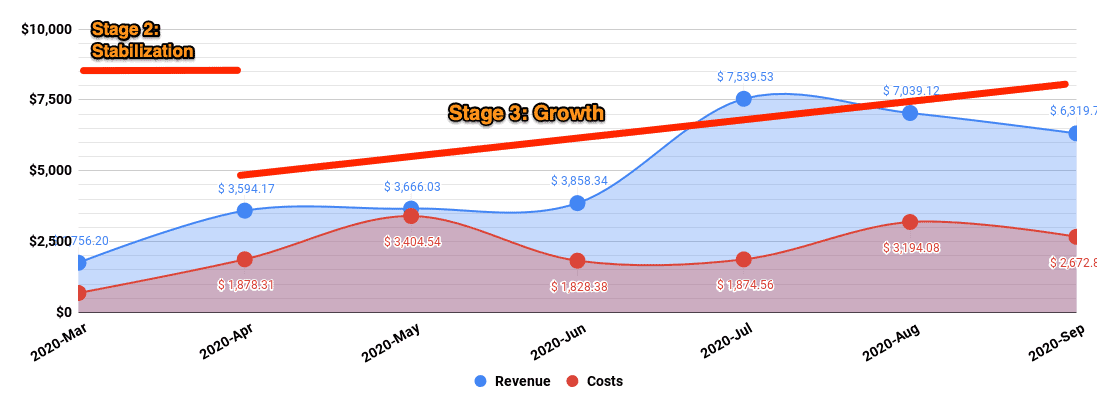

The worst thing a fund can do is acquire assets and wait for the cashflow to come in before ramping up for growth. You want growth to be from day one after acquisition (Stage 1). The proper strategy can be graphically shown as follows:

After the acquisition, Stage 2 (stabilization) begins which is essentially understanding the site and ramping up the content, CRO, etc. with the growth capital. This lends itself naturally to Stage 3 where the growth catches up and the cashflows start increasing.

5. Operating strategy does not make sense

What’s the operational strategy? Will the fund invest upfront for 6-months all of the growth capital plus cashflows? Will the fund invest all of the growth capital plus a portion of the cash flow over the course of 12-months?

There are many ways to run the operational strategy. One side of the spectrum delays instant dividends to investors from cashflow for the sake of growth, others provide dividends from day one and grow slowly. Each fund manager has their own thesis.

Personally, if I see room for improvement on an asset, I reinvest all cashflow plus earmarked growth capital from day one. I realize the profits later in its lifecycle. This is because content takes time to rank and start generating revenue; there is no reason to delay the reinvestment early on.

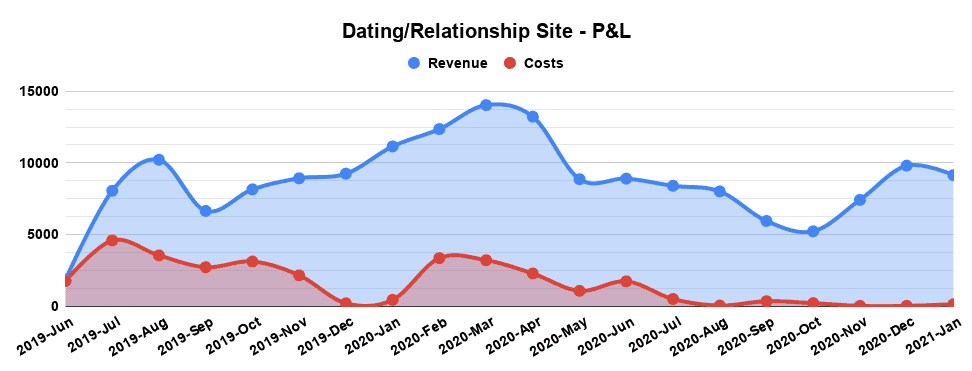

Here is an example of this being done on my dating case study site:

Early on after acquisition (see June and July 2019), all cashflow is invested back for growth. Note that the revenues, while shown in the current month, actually take 1-2 months to arrive in the bank account. Therefore, initially, I am reinvesting my own earmarked capital until true cash flow picks up.

6. Portfolio acquisition strategy does not minimize risk

A fund manager is a portfolio manager. Their job is to put together a porfolio that minimizes risk and maximizes returns. They should understand the basics of modern portfolio theory.

Modern portfolio theory (MPT) is a theory on how risk-averse investors can construct portfolios to maximize expected return based on a given level of market risk.

Investopedia

The “market risk” in the website space includes Google algorithm updates, commission cuts, brands going out of business, among others. Constructing a portfolio means having a thesis of the types of assets to acquire.

An example of a portfolio red flag would be over-leveraging on Amazon affiliate sites. I bring this up because Amazon cut commissions from 8% to 3% overnight in April 2020 which would render a portfolio less valuable if it was all Amazon sites.

Best Website Investment Funds: Top 3 Options

Website funds are still in their infancy. There are a few funds that have started up in the past year or so which I will cover below. I know the teams behind these funds, have done deals with them, and are A-class players in the industry.

1. WebStreet Empire Flippers Capital Fund

2023 Update: EF Capital has rebranded to WebStreet.co. They’ve been successfully operational since 2021 and have documented the ROI that investors have received.

Background

Empire Flippers Capital (known as WebStreet as of 2023) was launched in January 2021. Empire Flippers, being one of the biggest online brokers in the website investing space has been thinking of this idea for years now. That effort has come to fruition.

Think of EF as the “connector” platform between investors and operators; they themselves are not operating any businesses. On the website operator side, they are providing a platform to vet operators based on their track record, industry references, and strategies. On the investor side, they are enabling accredited investors to invest in each fund.

Highlights:

- Launched with 6 funds for content sites and Amazon FBA

- Sized $1M to $2M for each fund

- Operators do not have to worry about legal frameworks; EF handles all logistics and investor relations

- Operators will hire a dedicated team to operate this fund

Investment Structure

The minimum investment is $10,000 per fund and you must be accredited. As the investor, it’s your responsbility to read each operator’s deal page, understand their strategy, and then invest.

Many of the funds have earmarked capital (around 5-10% as I recommend). All of the funds have explanations in exactly what kind of team they will hire.

Investment capital allocation:

Each party below will inject capital based on the following breakdown:

- Investor capital: 90%

- Operator capital: 10%

- EF capital: 0%

Note: EF Capital is not an operator; they are a mediator/broker. They do not need to have “skin in the game” since they are not operating the businesses.

Quarterly Profit Dividend/exit payout

Each party below will receive dividends and exit profit share based on the following breakdown:

- Investor returns: 60%

- Operator returns: 30%

- EF Capital returns: 10%

The above breakdown of payouts occurs on a quarterly basis based on the profit the assets generate. Furthermore, if an asset is sold (minimum hold time of 12-mo), the initial capital is first returned to each party, and then the additional profit is split according to the percentages above.

An operator is receiving approximately 4.5 times leverage on their initial capital (i.e., $100K investment equates to $450K). This solves the age-old problem in this industry: good operators are not able to leverage their money using a traditional route (i.e., banks). EF Capital enables operators to leverage their money and simultaneously not worry about investor relations and business structures.

Fund administration costs:

- EF Capital Management will use 0.75%-1.5% of the fund to cover one-time administrative expenses (i.e., creating legal entities and securities registration fees)

Inner Workings

Through the fund launch, I’ve had a peek at the inner workings. Here are some of the important aspects to consider:

- Operators have 3 months after the funding round closes to acquire sites otherwise they forfeit funds

- Operators must acquire deals vetted by EF and available publicly on their marketplace. Operators are not allowed to source their own deals.

- Operators pay brokerage fees to EF when they acquire and also when they sell

- Operators must hold for at least 12-months before selling any single asset

- Investors and operators are “blind” to each other. Investors cannot assist operators, nor can operators reach out to investors.

The last point of the “blind” structure is interesting. Even if you are a knowledgeable investor with connections in the industry, you cannot help the operator. EF Capital has stated that in a future fund this option may be available.

My Thoughts

The EF Capital fund (now known as WebStreet) is an innovative step for the industry. It solves a few important problems in the industry:

- Operators cannot raise money since website asset classes are not understood by traditional banks, venture capital, etc

- Operators can focus on operating business, and let a third-party manage investor and legal relations

- Investors get the ability to diversify funds across 6 separate operators

Note that you still need to do your due diligence on the operators, their strategy, and the legal structures.

2. Domain Magnate Fund – Headed by Michael Bereslavsky

2023 Update: Domain Magnate is now defunct. This information is here for educational purposes only.

Background

Domain Magnate’s fund is headed by Michael Bereslavsky. Apart from running a top-notch website operations service, where their team will work with individual investors to acquire and manage individual sites, they also have a micro private equity fund.

Fund 1 Results

On November 2020, Domain Magnate released details on the results of their first fund. The acquired their first deal in January 2019 for the fund and continue acquiring up until July 2020.

The thesis of the fund was to acquire high-risk, lower multiple deals that had a high potential for growth.

In 1.5 years of operations, total of 9 acquisitions. The breakdown of returns is as follows:

- Total acquisition cost: $551,223

- Total revenue generate: $388,570

- Total expenses: $73,445

- Total exits after fees: $494,272

- Total profit: $809,397

- Paid out to investors: 469,183

Note: these numbers can be found on their fund results page.

Next Fund

Domain Magnate is starting their next fund in Q1 of 2021. Their team has grown in size from 10 to 20 people to handle another fund.

My Thoughts

Domain Magnate is a top-notch website operator. Their results from the fund showcase how they acquire businesses at low multiples, inject growth capital and then flip. It is the same model that I utilize; it works if the operator knows what they are doing.

They’ve been buying, growing, and selling websites for over 15 years. A plus point is that they have a deal sourcing team that is cold outreaching to business owners. This allows them to acquire good deals at favorable multiples.

Note: their website does not publicize the investment structure, returns, legal structures, etc. Make sure to review all of that information prior to investing.

3. Onfolio Dividend Fund – Headed by Dom Wells

Background

Onfolio is headed by Dom Wells. If you’ve been in the industry long enough, you know that Dom Wells was the former owner of Human Proof Designs, an agency catering to niche website builders. He exited that company to start Onfolio.

Onfolio started as a website operator with a buy and manage service. They recently launched their investment fund.

Investment Structure

Onfolio has launched a dividend income fund. They will provide a 12% annual return over 5 years paid out quarterly to investors. These are preferred shares. Investors do not get shares in the upside of the business, or exit.

Resources

For further details, you have to reach out via their website. They do have a video you can watch.

My Thoughts

Onfolio has made it simple: 12% return paid quarterly. Investors are investing in the entire portfolio; it’s not a single fund with select assets acquired by the operator. Note that the major upside is from growing a site and then exiting. While that is factored into the dividend in some manner, it is not reflected if one asset is able to 10X.

This fund’s structure (12%) can be compared to investing in a real estate syndication which typically pays out 8% annually, plus upside on the sale of the property.

Wrap Up: Funds Provide Diversification

As digital asset classes mature, more website investment funds will pop up. I see these funds as an excellent way to diversify from other investments (e.g., real estate, stocks, personal business) if you are an accredited investor.

You should evaluate your investment profile to see if a fund is right for you. Ask yourself these questions:

- Are you already a business operator who needs to diversify into different digital assets?

- Are you looking to diversify from traditional investments?

- Are you looking to invest and learn from the operators on how they operate? (may not be an option for all funds)

With any investment, vetting the investment structure, legal structure, operational strategy, and the operators’ track record is key.