I am excited to launch a new case study. This time though I am not the Operator of the website! I am an investor in the deal.

This case study will cover the month-by-month growth of this website leading to a sale, and how it works out when we have an Operator in place.

Let’s first cover the deal structure, then details of the website and why we purchased it.

👉 Partnership Deal Structure

This deal was done in conjunction with another investor. We wanted to find a way to leverage our expertise as strategic advisors only, but not give much time. The hypothesis was the following:

Could we find a good operator that would handle the day-to-day operations of the website following our advice when needed?

The structure we came up with was as follows:

- Investors: invest funds into the website acquisition and growth, provide high-level strategy, insights, industry contacts, etc…

- Operator: handles all day to day of SEO and social growth, monetization, optimization, etc

- Equity and Profit: 50% equity and profit share to Investors, and 50% equity and profit to Operator

- Exit: The strategy is to exit eventually in 12-24 months

📅 Day-to-Day Operational Structure

- Upfront Capital: Investors would front all capital requirements in terms of acquisition costs of a website

- Time Investment: Operator would invest their own time into the project. Investors are expected to advise only

- Ongoing Costs: Investors would invest further into the site for growth as needed

- Website Revenue: all revenue will have priority to be reinvested into the site for growth

- Website Profits: if any profit remains after reinvestment, it gets split according to equity percentages (i.e., 50% to investors, and 50% to the operator)

- Website Sale: If we sell the site, first the Investors’ capital is returned (i.e., original purchase costs and growth costs), then the remainder of the sale proceeds is split based on equity percentages

It’s a fairly simple structure!

Worst-Case Scenarios

You always have to work out the edge-case. Here are the common ones:

- Website Underperforms: if the website does not perform to expectations, the Investors lose out. They can cut loses by selling the site for whatever value it can get

- Operator Underperforms: The Investors reserve the right to replace the Operator if they do not perform their tasks. The Operator has to really underperform (i.e., no work performed) for this to take effect

- Investor wants to exit: If one of the Investors wants to liquidate their shares for emergency reasons, then another Investor can purchase the equity at a reduced multiple. Or the alternative is the website needs to be sold on the market so everyone exits.

- Operator wants to exit: if the operator wants to exit, they can do so but at the penalty of their equity being forfeited back to the Investors

Why is the Operator given so much equity?

Short answer: to keep them motivated for long-term growth

The Operator must be given enough equity so they put in the effort and stick around long-term. They are not paid a fixed salary in our deal structure. This is because we are not treating them as an Employee, but rather a Partner.

You can always find a website Operator (i.e., essentially a VA) to manage a site on a fixed monthly salary. But will they really go out of the way to find different monetization opportunities, go the extra mile to increase traffic, and more? I doubt it. They will do the bare minimum to earn the salary. Giving equity is a way to inventize the Operator to do more than just “maintain” the site.

The Operator does not get paid any cash unless there are significant profits, or the website is sold. Exactly the same way the Investors are paid. Our incentives are aligned!

🧑🦱 How did we find the Operator?

The Operator came from our network. (Yes, we got lucky!)

He has expertise in social media and SEO growth. He has a technical background (i.e., Engineering) so is able to customize websites and write code, if needed. He has also successfully set up email campaigns that bring in revenue.

Overall, it can be said, the Operator knows what he is doing.

He is still learning some intricacies of positioning a website from the beginning to be ready for an exit. However, we, the Investors, fill that gap of knowledge.

Now let’s discuss the website itself that we purchased!

📊 Wellness Website Stats

- Niche: wellness, healthy living

- AHREFS DR: 25

- Referring Domains: 124

- Backlinks: 425

- Revenue: ~$300/month

- Monetization: Amazon Associates, ShareASale, eBooks, Private affiliate programs

- Traffic: 7,666 pageviews (last 30 days)

- Age: November 2017

- Purchase Price: $5,650

The website covers wellness and healthy living. It was managed by a person that was passionate about the topic thus leading to high-quality content.

The website came with many assets such as two e-books, an opt-in email list of 1,000 subscribers, and PDF downloadable. The website also came with a healthy Pinterest account.

Why did we buy this site?

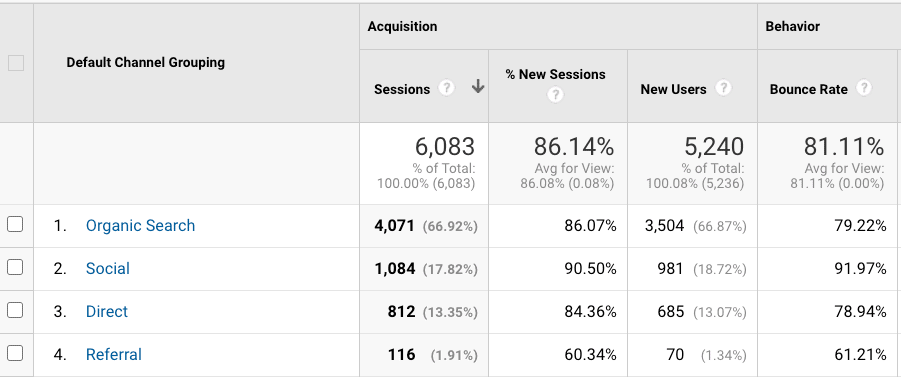

Diversified Traffic Sources

Nowadays with what’s going on with Google (e.g., May Core Update, glitches), having a site with diversified traffic is crucial. This website has traffic from both Organic, Pinterest, and Email list. This was a major reason we purchased the site.

Last 30 Days Traffic By Source

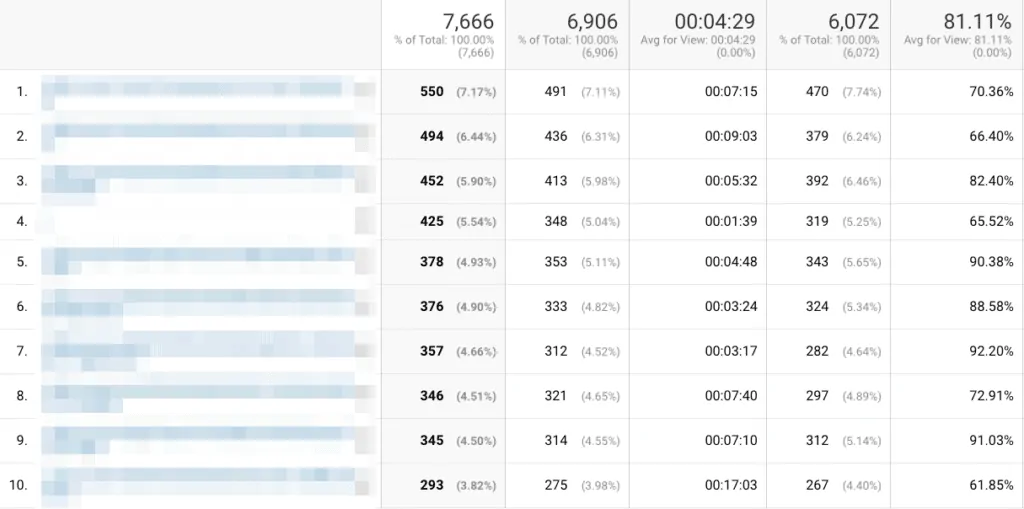

Diversified Traffic To Pages

You do not want to have a site where most of the traffic is going to 1-3 pages. You want a site that is diversified across many pages.

No page on this site has more than 10% of the traffic! That’s hard to come by. It’s extremely diversified. Check out the Google Analytics screenshot:

Diversified Revenue Streams

I love to buy sites that are underutilized and under-monetized. This site fits that criteria perfectly.

The site from the get-go had 3 major sources of monetization going on:

- Amazon Associates

- ShareASale programs

- eBook Sales

In addition, it was clear the site was not using the right affiliate programs to monetize. There are higher paying offers out there and they just need to be tested. In this niche, Amazon Associates is not the best option.

Our long-term goal is to add even more revenue streams.

Additional Assets

The site comes with various additional assets such as:

- Downloadable PDFs: Can be used throughout the site to obtain more email subscribers, or bundled up to be sold

- eBooks: two ebooks are included. One of them sells for $10, another is free.

It can be expensive to have a properly researched eBook written. That in and of itself can cost $500 or more.

Rant: this is a gripe I have when selling websites. The industry does not value the different assets, only the multiple on the income. The value of the domain, PDF assets, ebooks, email lists, goodwill, trademarks, etc. are not factored individually.

Not every asset of a site leads to income but it does lead to brand recognition. This is something that needs to improve in the industry of website flipping.What Can Be Improved in August 2020?

The Operator is working actively to do the following in August 2020:

- Stabilize Earnings: The Operator is optimizing the pages that get traffic for earnings. They are replacing/updating Amazon links using AAWP plugin, adding in comparison tables, and product boxes.

- Content Audit: a content audit from the get-go will let us know which pages generate traffic and have backlinks. We can then repurpose articles that are non-performing

- Backlink Audit: disavow any clearly bad backlinks

- Pinterest Management: Operator will deploy a Pinterest strategy to consistently pin using Tailwind

- Optimize site speed: Utilize plugins like WP Rocket and ShortPixel to optimize the site for page speed

- New Content: The plan is to find writers, perform keyword research using AHREFS, put together outlines, and hopefully get a few articles posted.

August will be the month of stabilization to put us in a position for exponential growth 🤞.

Wrap Up

We are very excited about this Investor-Operator partnership.

I will be updating this case study monthly. Stay tuned! If any questions, just leave a comment.

Have you done any type of partnerships like this? Share details in the comments!