As you hone down your skill sets in finding good websites for sale, doing due diligence, and then operating the websites, the issue most people will run into is securing funding to acquire more sites.

Traditional funding institutions do not fully understand the website investing world in its entirety. If you partner that with the fact that content websites do not have “assets” that can be leveraged by the funders in the worst-case situations, it’s tough to raise money.

In this write-up, I walk through 10 different funding options, my experiences, pros, and cons of each. I will cover:

- Results of a survey

- Funding options for beginners

- Funding options for experts

- Common questions

Let’s get to it!

📊 Survey Results: 68% Have Bootstrapped Acquisitions!

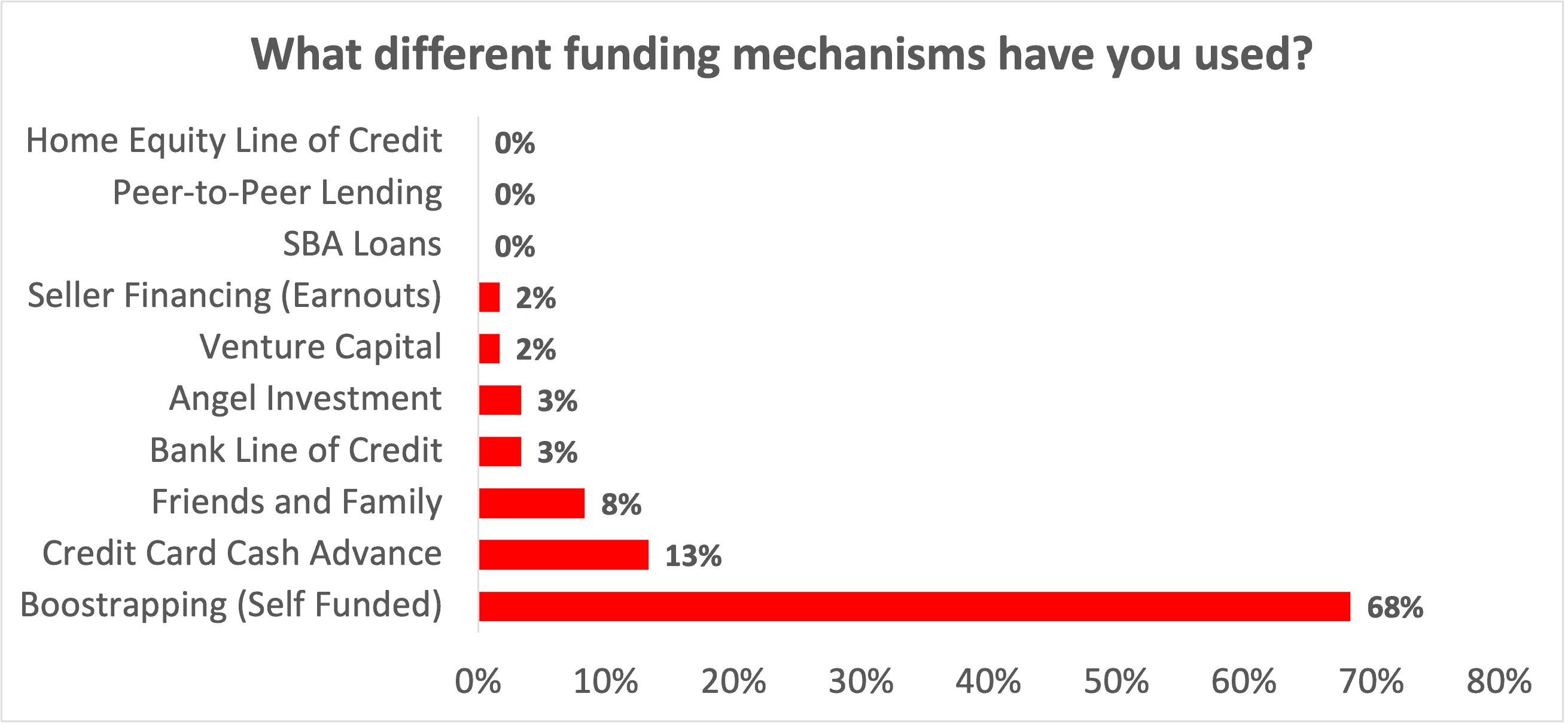

In the Website Flip Facebook group, I did a non-scientific survey to see the different ways people funded their website acquisitions. I asked the group members this: what are the different funding mechanisms you’ve used for acquiring content websites?

Check out the results:

From the results, the majority have bootstrapped (self-funded) their acquisitions, and a subset of people have used credit card cash advances, friends and family, and bank lines of credit.

Let’s get into discussing each of these options from the perspective of content-based websites.

👉 Beginner Friendly Funding Options for Acquiring Content Websites

The following options are coined as beginner-friendly in the sense that most of them are backed by your own personal funds, connections, and/or credit. These are just ideas. Your mileage will always vary based on where you are located, your experience, and your personal situations.

1. Self-Funded (Bootstrapped)

The most popular method of using your own money to get started. Using your own money gives you the freedom to experiment and if the project does not work out financially, you are not stressed that you owe someone or an entity their money.

My Experience

I started in 2008 with my own money that I had saved up. One successful website flip led to the next and I grew my capital over time.

Pros

- No entity/individual to return funds, provide updates, etc.

- Ability to try new things that may be risky without backlash

- Build/learn at your own pace

Cons

- Limited scalability

2. Friends and Family (F&F)

Another approach many entrepreneurs take is utilizing their direct relationships with friends and family. The terms of the deal can be favorable. Some friends and family may not ask for any profit; just their initial capital back. Some friends and family may ask for a minimal return.

In general, if you personally do not have the capital to invest, friends and family will be your next best bet for the most flexible and favorable terms.

Pros

- Usually flexible terms

- May not ask for a significant return on investment

- Willing to “let it go” if the investment goes sideways

Cons

- Semi-limited scalability (you don’t have that many “rich” uncles)

3. Credit Card Balance Transfer (0% APR Offers)

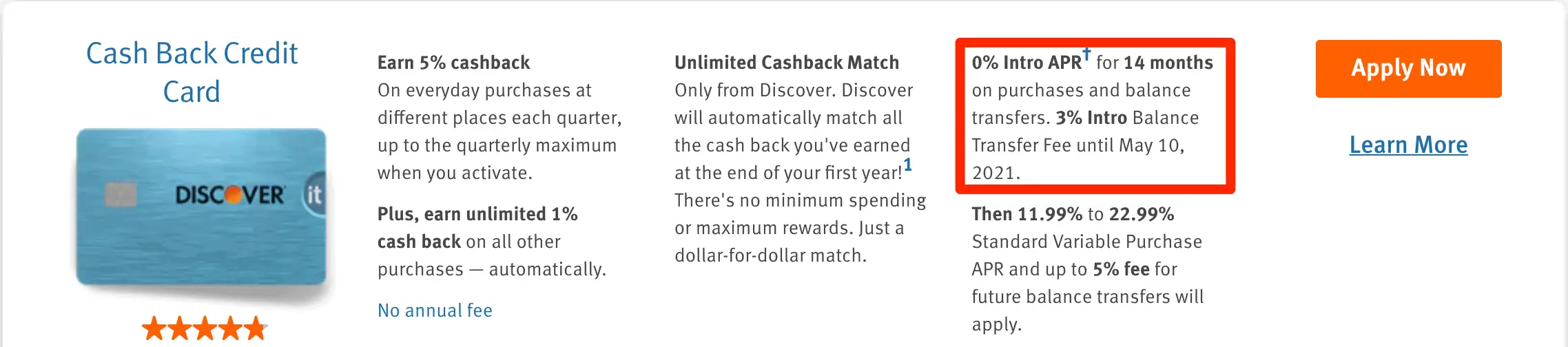

If you know what you are doing, buying a website with a credit card cash advance may be an option. You are looking for credit cards that offer introductory offers of 0% APR over 12+ months. The majority of such cards won’t charge you interest for this introductory period but will charge a 3%-6% one-time fee for balance transfers.

My Experience

In the early days of my journey in website flipping, I acquired a website from Empire Flippers which was funded via a cash advance on a 0% APR credit card. I had a 14 month period of 0% interest and paid a 3% upfront fee to get access to the funds from the credit card.

These offers are readily available from almost any major credit card provider. Check the one out below:

Every month, all the profit would be put back into paying down the credit card balance. I was able to pay off the balance in 6 months.

I did this because I am confident in the assets I acquire and my skillsets. This is not for first-timers because if the website you acquire does not perform, you are still on the hook for the credit card balance.

Pros

- Opening of a credit card to receiving the cash advance can take only 2-3 days max

- 0% interest rates for 12-14 months usually

Cons

- A credit card is tied to your name (high risk)

- Good credit history is required to get accepted

4. Bank Line of Credit (LOC)

A LOC is revolving when obtained from a bank. This means you can use the account whenever you want and withdraw as much as you want up to the allocated balance. It’s a powerful option that I personally use to acquire sites.

My experience

The process of getting a LOC is cumbersome. My bank (JP Morgan Chase Bank) required 2 years of business tax returns showing growth, current year P&L reports, and personal credit score check.

They provide a LOC of 25% of the average of the past two years’ revenues. For example, if your last two-year average revenue is $300,000, you can obtain a $75,000 LOC.

The terms were as follows:

- A variable interest rate of 5%-6% (adjusts with US prime rates)

- Annual fee of $149

I’ve had my LOC for 6 years now. Since I flip websites, my revenues year to year can vary significantly. However, my bank never re-adjusted my LOC limit so that’s a plus.

Pros

- A bank account with a fixed limit. You can use it however you want.

- Favorable interest rates with a long-term amortization window

- Minimal annual fee

Cons

- A long process with many documents

- Personal guarantee required

- Credit score check required

5. Home Equity Line of Credit (HELOC)

If you have a primary residence or rental properties, you can open a HELOC. Like a business LOC, a HELOC is also a revolving source of funds that you can access at any time for any purpose.

Example

Most lenders will allow you to access up to 85% of your home’s value. For example, if your home is valued at $600,000 and you own $300,000. You can get up to 85%, thus $510,000. Substracting off the $300,000 leaves you with a balance of $210,000 which is your available HELOC balance.

Pros

- Lower cost interest rates that are fixed (not variable)

- Ability to have a revolving source of funds

Cons

- Tied to your real estate properties

- Requires equity in your properties to tap into

👉 Expert Funding Options for Acquiring Businesses

If you have a successful track record, more capital to deploy, and a team, the following options can be ways to level-up.

1. US Small Business Administration (SBA) Loan

The Small Business Administration has a favorable loan mechanism to acquire assets. The SBA loans are issued through authorized banks and specialists. The entity providing the SBA loan will review various aspects of the business from its multi-year P&L, the buyer’s resume, business longevity, business margins, and the industry as a whole.

Typical content-based sites have no true assets (i.e., no inventory, no software). Therefore, it’s difficult to receive an SBA-backed loan for a pure content site.

Experience

Ryan Condie over at Let’s Buy A Business Podcast acquired an SBA loan for an asset his team purchased from FE International. The business acquired was RentLingo, a go-to resource for real estate rental property resource. It’s a combination of software with content.

Check out Ryan’s breakdown of his SBA loan here, plus his breakdown of the acquisition.

Pros

- Ability to leverage your money

- Downpayment around 25-40% depending on the deal

- Can pay down the bank debt early without penalty

Cons

- A personal credit guarantee is required

- Experience is required; not for first-timers

- Can be a long process to close; 6-9 months

2. Peer-to-Peer (P2P) Lending

P2P lending is when you borrow directly from investors through a lending platform. It’s crowdfunding. The platform sets the rates and terms of the transaction based on a risk profile.

For example with LendingClub’s platform, you can borrow anywhere between $5,000 to $500,000 with minimal interest rates at 5% (usually higher in the 8-12% range) with fixed monthly payments on the term length of 1-5 years. The step-by-step process is highlighted below:

The requirements for the business are to have 12-month history, at least $50,000 in yearly revenues, no bankruptcies, and that you own at least 20% of the business.

This can be an interesting method to receive funding to acquired niche websites. However, keep in mind that it’s crowdfunding so there are no guarantees that investors will provide you with the funds.

Pros

- Requirements to get started are minimal

- P2P lending has matured over the years to be a good platform to raise funds

Cons

- High interest rates

- Short payback period (1-5 years opposed to 10+ years on other options)

3. Angel Investors

Most angel investors either want equity in the business (in this case a specific website) or a higher than average rate of return on their money. Most angel investors understand they are providing funds for high-risk ventures.

Most angel investors are looking to invest less than $500,000. I’ve seen angels put in $50,000 on deals with minimal equity.

Pros

- Angel investors are not looking for immediate payback. They are OK with waiting.

- Can be a partner with equity

Cons

- Will require a detailed business plan and financial model

- Will require significant due diligence

- Will require a legal entity to their liking

4. Venture Capital (VC) and Private Equity (PE)

If you want to raise significant amounts of money, venture capital and/or private equity is your best bet. The institutions have backed firms like Red Ventures and Dot Dash, who own some of the most well-known authority websites on the Internet (e.g., Investopedia, VeryWell, Spruce).

They’ve invested in these companies since they’ve structure themselves as new-age “media companies” that are in the business of acquiring viewership.

In essence, niche website builders do the same thing but on a much smaller scale. While this type of funding is an option, it’s a difficult and long road ahead.

Pros

- Receive significant windfall of funds to acquire and grow assets

Cons

- Forfeit significant equity in the business

- Requires significant legal fees to structure your business to be investable

- Oversight

5. 🆕 Website Operations as a Service (OaaS)

The business model of becoming a dedicated website operator (i.e., operations as a service or OaaS) has been gaining traction. In this structure, you acquire websites on behalf of hands-off investors, and then you manage the asset. In return, you receive profit and equity share. In some instances, you will need to have “skin in the game” with some of your own money. However, being an operator gives you the ability to leverage your money.

For example, you may be acquiring a website for $100,000 and only required to put down 10-20% of the initial capital.

There are two avenues for website operations:

- Management with your own “angel investor” group: if you have access to angel investors, then you can operate websites for them

- Website investment funds: Operators can get access to funds through a pool of investors

Pros

- Ability to leverage your personal funds

- Ability to scale quickly and acquire bigger websites

Cons

- Not for first-timers; you need a successful and provable track record of operations

- In-house teams will be required; no solo operations

- Legal structure needs to be in place for worst-case scenarios if a website underperforms

- Requires detailed business plan, financial model, and growth strategy

Common Questions about Funding

If I am a beginner, what’s my best funding option?

Bootstrapping. Build your own website from scratch or acquire a smaller website to learn the game. Level-up to bigger deals over time.

How do I explain my business to those who want to invest?

I’ve had this issue: how to explain my business. What we do is not standard run-of-the-mill. My local bank, friends and family, insurance brokers, etc. all lack the understanding of what an “online media company” does.

My explanation nowadays is as follows: my team and I manage an online media company that owns an in-house portfolio of websites. These websites receive viewers from search engines and social media and are monetized by brand partnerships, advertisements, products, and more.

What are examples of media companies that have raised funding?

Here is the master list:

Red Ventures

Dot Dash

Future PLC

Meredith Corporation

Leaf Group

Internet Brands

Hearts Media

Ziff Davis

This is a selection of companies that have successfully raised funding from private equity, venture capital, and/or are part of the public stock markets. A full analysis of media companies can be found here.

🤝 Wrap Up: Should I Raise Money?

The most risk-free option is to always use your own funds. However, as you grow an in-house team, expertise, and have a proven track record, it’s inevitable that the idea of raising money will be something that crosses your mind.

Whenever you are looking to level-up, make sure to ask yourself these questions:

- Does this funding option allow me to be worry-free (i.e., sleep well at night)?

- What are the worst-case scenarios?

- What are the best-case scenarios?

I always make sure that whenever I bring in outside money, whether that be individuals or banks, I can justify the risk involved and at the end of the day to make sure I sleep well at night. That’s the most important factor.