Performing due diligence when buying a website is following a set of guidelines to ensure the asset you are purchasing matches your risk tolerance and investment criteria.

When I do due diligence, I am looking for ways to say NO to the deal; essentially finding the red flags that go against my investment criteria.

In this guide, I will cover how to do due diligence when buying a website. I’ve developed a 7-step framework that has been battle-tested across 1,000+ websites reviewed and 218+ successful acquisitions since 2008. At the end of the article, you will find a website due diligence checklist and further resources to learn from.

Let’s get into it!

BATTLE-TESTED RECOMMENDATIONS

WebAcquisition – Hire Due Diligence Experts

Mushfiq and his team of M&A experts have over 50+ years of combined experience performing due diligence on content websites. Our due diligence process reviews 22+ critical points of each acquisition to catch red flags.

Our goal is to provide unbiased expertise to help you acquire your next online business. Learn more today!

The Course On Website Flipping

Digest a decade of experience in a single day with this jam-packed course covering concepts of buying and selling websites. 6+ hours of actionable video content showing you how to achieve 6-figure exits!

My video lessons cover hands-on due diligence, valuations, finding sites, positioning sites for sale, and much more. Get $100 OFF today!

7-Step Website Due Diligence Framework

These are questions that are running through my mind as I do due diligence on a website:

- Website/Domain: Is the URL brandable? Are there any trademark/copyright issues? How old is the site?

- Niche: is the niche interesting? Are there growth opportunities?

- Traffic Trend: Which direction is traffic trending? Stable, upwards, or downwards?

- Toxic Links: Any easy-to-spot toxic links?

- Monthly Revenue and Costs: How much does it earn monthly? What are the minimum operating costs?

- Monetization Sources: What are the monetization sources? Are they sustainable?

- Content Quality: is the content legible? Written by an “expert”? Is it AI or human-written content?

Data Prerequisites

To perform due diligence, I ask the seller for data and guest access to accounts. This includes the following:

- The URL of the domain (if it’s redacted for any reason)

- Guest access into Google Analytics to review traffic

- Guest access into Google Search Console to review organic traffic

Let’s break down the above framework.

1. Review the Website Domain

Branded Domain?

I like to buy brandable domains as opposed to exact or phase match domains. Here are examples:

- Brandable: Kitchenista.com, KitchenExpert.com, KitchenGuide.com

- Exact Match: BestAirFryer.com

With a brandable domain, you have room to expand into shoulder niches within the main niche. With the kitchen example above, if one had an exact match domain about air fryers, it would be strange to have unrelated products such as cookware on the site.

Note, however, that the phrase and exact match domains are perfectly alright to use; my personal investment criteria do not allow for it.

Domain History

Domain history is extremely critical. I use Archive.org to check the history of the domain I am looking to acquire.

Here are the steps:

- Go to Archive.org and type in the domain

- You will now be presented with snapshots of the site historically

- Review a bulk amount of the snapshots manually

What we are looking for is if the domain had the same type of content throughout history. For example, if you are buying a pet-focused site, you do not want to see content about kitchenware. That’s a red flag.

Even more of a red flag is finding content in a different language, adult content, or casino-related content.

Website/Domain Age

How long has the website been around? I like to buy sites that are at least 1-year old; some prefer longer. If you are looking for sites that have been around for decades, you will not have much luck so having a smaller time horizon ensures I have access to enough deal flow.

The website age is critical. A site that is just 6-months old will be riskier as it has just most likely started to obtain traffic.

There are a few ways you can check the site’s age:

- Check Who.is records for when the domain was registered

- Ask the seller when was the first article added to the site

Check for Trademarks

I also look for any trademarks/copyrighted names within the domain. Stay away from domains that put a brand name in the URL. For example, NikeShoes.com. Any brand can submit a DMCA takedown notice and you will have to take the site offline or get into a legal battle, which you will lose.

Here are the steps to follow:

- Ask for the URL from the seller

- If you think the URL is branded, use the USPTO Trademark database to search for the brand keywords

Read this write-up on analyzing domains for trademark for more details.

2. The Niche

The niche of the site you are looking to acquire is semi-critical. In general, it’s possible to make money in any niche, however, some niches have higher commissions, display ad RPMs, among other factors.

Here are questions you need to ask yourself:

- Does this niche interest me? You are buying a real business; if it does not interest you slightly, it may not be the right fit.

- Does the niche have multiple revenue opportunities? Do affiliate products exist? What are the competitors promoting?

- Is the niche going to be around long-term?

- Are there a bulk amount of keywords to go after? Are they low-competition keywords?

- Can I hire writers at affordable prices in this niche?

You do not want to buy a site in a niche that is a short-term fad (e.g., fidget spinners). You want a niche that has plenty of low-competition keywords, enough traffic volumes, and many different revenue streams.

Example niches with such criteria include:

- Pets

- Home

- Kitchen

- Finance

Check out this guide on how to pick a niche for your website for further details.

3. Traffic Trends

The first criteria to consider is the overall trend whether stable, up-trending, or down-trending. The second criteria consider how many months the trend has to be valid.

I primarily use Google Analytics and third-party tools like AHREFs and SEMRush to verify.

Analyzing Google Analytics for Red Flags

I always make sure to obtain access as a guest user in the website’s Google analytics account.

Here are the things you should review for last 30 days, last 6 months, and last 12 months:

- Top pages getting traffic: no page should get more than 15% of traffic across

- Time on page: should show a value above 1 minute

- Pages per session: the higher the better

- Bounce rate: should be less than 90%

- Traffic sources: primarily should be organic traffic (unless you are buying a site with social traffic)

- Geography: make sure traffic is from the countries that you want them from

This will give you a good sense of if the site is healthy, and what follow-up questions to ask the seller.

Finding Traffic Trends with AHREFs

Here is the process I follow to find traffic trends:

- Obtain the URL from the seller

- Plug it into AHREFs or SEMRush

- View the Organic Search traffic chart

- Review All Time, One Year, and Last 30 Days traffic trends

Depending on the traffic trend and your pre-determined investment criteria, it will provide you more insights on what questions to ask the seller to understand what they may have done or what has happened to the site for the trend to occur.

All website investors naturally want to buy a site on an uptrend. However, if the uptrend is extremely steep, then that can be a red flag.

To make this more clear, I took snapshots of random sites’ traffic via AHREFs to provide examples of how I obtained insights.

Example 1

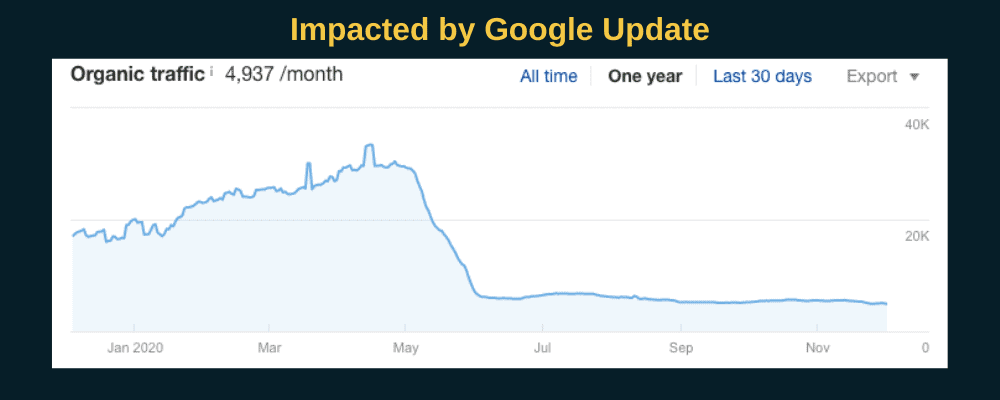

This specific website was impacted by the Google Core Update in May due to the quick jump in traffic. The site then stabilized at its equilibrium after the update. The owner definitely made some updates causing the recent uptrend.

Quick follow-up questions to ask:

- Any ideas why the site was impacted by the Google Algorithmic update in May? (note: this is a leading question to see if the seller is honestly stating the facts)

- What changes were done to the site post-Google update?

Example 2

This site was impacted by the Google Core Update in May. The site has stabilized at 30% of the traffic it was getting (again just an estimate). The site has not been able to recover from the algorithmic Google update.

Example 3

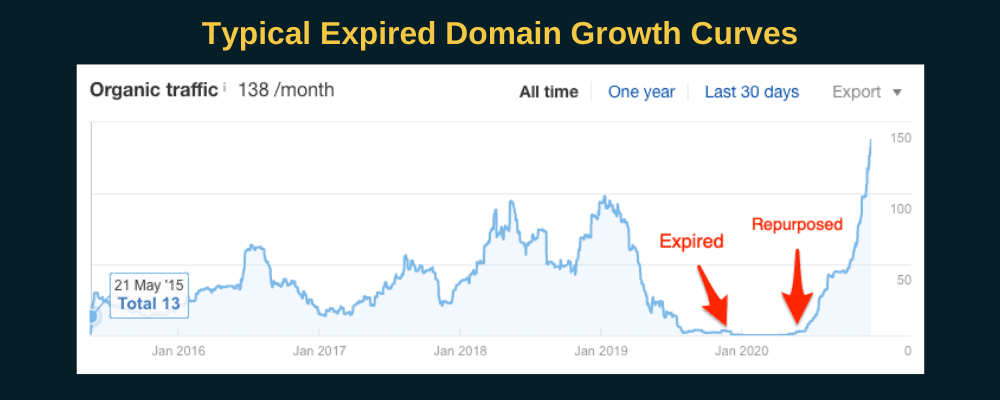

If you see a flatline and then growth, this usually means the original domain has been repurposed by a new owner. This can happen in one of two ways: (1) the same owner shut down the website for whatever reason and then later decided to continue growing it, or (2) the domain expired, the seller purchased it, and started building (i.e., an aged domain strategy).

The most likely scenario is #2.

Quick follow-up questions to ask:

- Was this built on an expired/aged domain? If so, where was the domain obtained from? When was it purchased?

Example 4

Extremely high-growth in a 1-year time period. This can happen in these situations:

- Site was built on a powerful expired/aged domain targetting very low competition keywords

- Powerful backlinks and content added simultaneously; the blitz approach

When you see growth like this, make sure to ask further questions on what was the strategy.

Note: in the example above, this was an expired domain that was rebuilt.

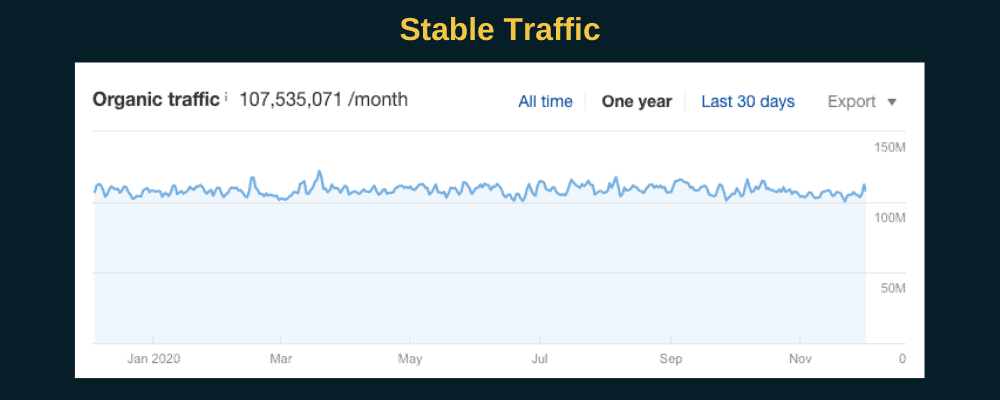

Example 5

This is self-explanatory. The site has been stable over the last year.

At first, seeing a site like this is great. I, however, personally do not move forward unless I see easy wins for growth. A stable site is a dividend-paying investment but without growth potential, the ROI is not accelerated. That’s my criteria. Yours will differ.

4. Low-Quality and/or Toxic Backlinks

I personally stay away from websites that have backlinks from Private Blog Networks (PBNs). That’s part of my investment criteria. However, I know people who do very well with PBNs. It all depends on what you are comfortable with.

Typical types of links that raise a red flag for me:

- PBNs

- Spammed international links (.ch, .ru)

- Adult links

- Casino links

These types of links can be spotted at a glance from various tools like Ahrefs, SEMRush, Moz, Majestic, among others.

Here is the process I follow:

- Plug in the URL into your favorite analysis tool (mine is Ahrefs)

- Go to Backlink on the menu bar

- Choose “One Link Per Domain”. This reduces multiple links from the same domain to give you a more summarized overview

- Sift through the first 2-3 pages

- Make a note of spammy links

While the above are clear red flags, there are other aspects to double-check as well. They include:

- Are the anchor texts of the backlinks too focused on specific keywords?

- Are there too many backlinks from one type of strategy (i.e., too many blog comments vs in-content links)?

- Are there private blog network links?

5. Monthly Revenue and Costs

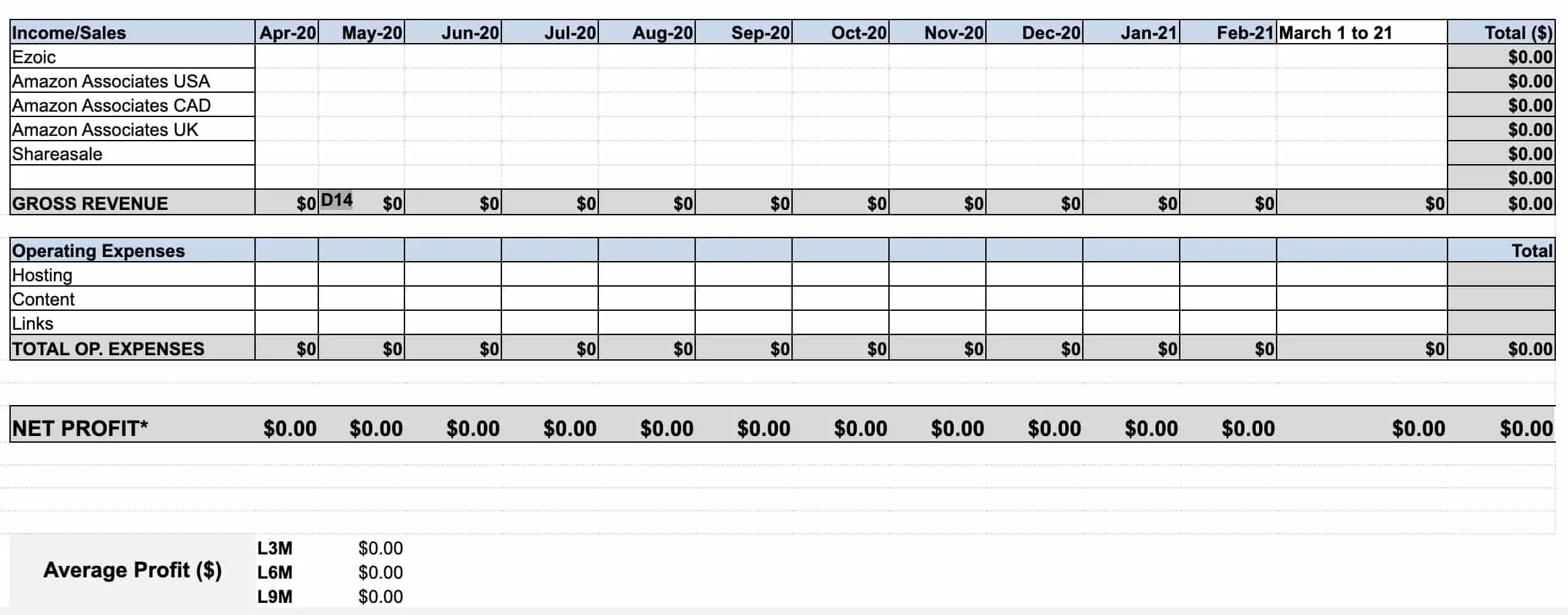

I like to ask the seller for a P&L outlining the last 12-months of revenues and costs. If the seller does not have a P&L created, I provide a template that I am comfortable with and ask them to fill it out.

Here’s a snapshot of my template:

You can download my template below:

After receiving the P&L and screenshots, I am able to verify the earnings. I can then also calculate industry-standard metrics. They are:

- Last 1-month earnings (L1M)

- Last 3-month earnings (L3M)

- Last 6-month earnings (L6M

- Last 12-month earnings (L12M)

Each of these is average profits across a certain time period. You can use these metrics to understand at a quick glance the trend, whether upward or downward.

These metrics are also used as the baseline calculation in valuing a website for sale. Most brokers and marketplaces utilize an L6M average to set the baseline profits.

Bonus tip: For further due diligence of revenues, you can ask the seller to create a video screen share of them walking through the accounts showing the revenues in real-time.

6. Monetization Sources

In your criteria, make sure to also have an understanding of what types of monetization sources interest you.

For example, I only get involved in content-based sites earning from display ads, affiliate marketing, or digital products. I do not get involved in content sites that sell leads to local businesses, or content sites that sell services.

The website for sale listing or the seller can provide you with the info on what are the various monetization sources.

A crucial aspect to consider is whether the different partnerships (if any) the seller has set up will transfer to you. For example, in my dating site case study, we have private partnerships for affiliate payouts that we’ve negotiated. The seller of that business will want the same payouts otherwise it’s an immediate revenue hit on day one after purchasing.

Here are some things to consider:

- If you are buying an Amazon Associates site, make sure the seller is not on a unique commission structure

- If the site is on Mediavine or Raptive display ad networks, make sure the site meets the minimum page view requirements. Mediavine requires 50,000 and Raptive at 100,000 views per month

If the site at one point had enough traffic to join the networks, selling the site may trigger the ad networks to review the sites again. If the site does not have enough traffic, this could be risky. Make sure the seller confirms with the ad network that the transfer will be allowed to you as the new owner.

7. Content Quality

Content is one of the most important aspects when it comes to websites. It’s the bread and butter of a website that search engines analyze to deem if you are worthy to be ranked for keywords.

With the advent of artificial intelligence (AI) tools out there that auto-generate content on the fly, it’s more critical than ever to understand how to evaluate a website’s content for its true quality.

When reviewing a website to acquire, I do the following:

- Read various articles on the website (recently published, and ones published years or months ago)

- Analyze excerpts within the content to see if (1) it has proper grammar, (2) is written by an “expert”, or (3) is written by an AI software

Spotting grammar errors and understanding if the content is “expertly” written is easy to spot. For expertise, you can tell from the content tone, data they share, and sources they cite if the writer knows what they are writing about.

The challenge because if you are trying to depict if content is written by AI. There is nothing wrong with AI content sites if that’s what you are acquiring. But oftentimes, sellers hide the fact they used AI software.

AI content is a bit “robotic” when you read the content out loud. Read the content out loud to understand the flow. You can use detection software to check if content is AI but those are not very accurate.

Website Due Diligence Checklist with 46 Questions

Looking to learn how to do website flips? Join the newsletter to get detailed guides, reports, and websites for sale. I share my insights from 14+ years and 218+ successful flips. No fluff guaranteed.

To summarize, here is a due diligence questionnaire of ALL the questions that go through my mind when I want to buy a website. Not all of them will be relevant to your case.

Basic Questions

- Is the seller trustworthy? Have they sold sites in the past? Can you verify their identity online?

- Will the seller provide after-sale support? For how long? For what type of situations will the help?

- Is the seller willing to use an Escrow service to close the deal?

- How long has the seller owned this site? Are they the first owner?

- Does the seller have sites in the same niche that could cause competition?

- What are the reasons the seller has for selling the site?

- Will the seller provide screenshots of revenue from each source?

- Will the seller provide a detailed P&L spreadsheet?

Domain Questions

- Is the domain branded?

- Does the domain have any trademarks or common brand names?

- Are the other top-level domains (e.g., net, org, com) being used? Will this cause any issues?

- Are there any expired/aged domain redirects pointing to the site? If so, are those domains included?

Platform Questions

- What platform is the site on? Is it Wordpress?

- Will the buyer need to purchase licenses to any of the plugins used on the site?

Niche Questions

- Does this niche interest me?

- Does the niche have multiple revenue opportunities? Do affiliate products exist? What are the competitors promoting?

- Is the niche going to be around long-term?

- Are there a bulk amount of keywords to go after? Are they low-competition keywords?

Content Questions

- Does the site come with any writers who are willing to continue writing?

- How much did you pay writers to write the content?

- How many total articles are on the site?

- How many total words are on the site?

- Does the content have many grammar or spelling mistakes?

- Was the content written by native English writers?

- Is the content duplicated anywhere else?

- Was the content written by AI tools?

- When was the first article published?

- When was the last article published?

Backlink Questions

- Are the anchor texts of the backlinks too focused on specific keywords?

- Are there too many backlinks from one type of strategy (i.e., too many blog comments vs in-content links)?

- Are there private blog network links?

- Are there any toxic backlinks (e.g., Chinese, Russian, casino, gambling, drug, adult)?

Traffic Questions

- Does the site have stable or growing traffic in the past 3, 6, 12 months?

- Is traffic coming from countries that you expect?

- Was the site impacted by any Google updates in the past 12-months?

- Is traffic diversified across top pages?

- What source (e.g., organic, social, email) brings the majority of the traffic?

Earnings Questions

- Will all of the affiliate partnerships continue if I buy the site?

- Is the seller on a custom rate card on Amazon Associates?

- Does the revenue trendline match up with the traffic trendline?

- Are there any recurring revenue streams? If so, does the buyer get access to the accounts?

- What are the minimum operating costs? Can I save money by placing this site on a server I already have?

Other Questions

- Will the seller provide access to all of the social media profiles?

- Is there an email list? How many subscribers? Which email service provider? Will the seller give access to the account?

- Are there any digital assets, such as e-books, courses, etc., included with the sale?

- What are some ideas to grow the websites?

Common FAQs about Due Diligence

How do I perform due diligence after a Google Core update?

Google is known to do periodic Core updates. These updates benefit some and are detrimental to other niche websites in terms of traffic changes. If you are looking to buy a website after a Google Core update, you need to be extra careful.

When doing due diligence, keep an eye on the traffic of the website in Google Analytics and third-party tools, like Ahrefs. Google Core Updates typically last a period of 2-weeks after being announced. However, 1-week prior and 1-week after are also “tremor” periods where changes take place. In reality, there is a 4-week window in total when an update is taking place.

If a site looks like it’s been negatively impacted (i.e., lower than normal traffic), you will need to re-evaluate your reason for buying the site. If it has many easy wins, it may still be worth buying even at lower traffic levels. However, in that case, make sure to adjust the price you are willing to pay for the site.

If a site has been positively impacted (i.e., higher traffic), this is a good sign to go ahead in acquiring the website.

Further Due Diligence Resources

Mastering due diligence takes time and one article cannot cover every detail.

Here are resources to understand the business model and intricacies of sellers/brokers:

- Understand the financial model of website buying and selling

- Understand how you will fund this website acquisition; self-funding is your best bet

- What are common reasons why sellers sell sites

- Understand the different website brokers in the market, or the different scams on marketplaces like Flippa

- Understand the benefits of using an online Escrow service to close the deal

- Detailed insights and strategies from selling 39 websites

Here are resources to understand the specific website:

- How to pick a good niche

- Read our insights when we acquired our health and wellness case study sites

- Spotting expired domain redirects

Here are dedicated resources for due diligence for specific business models:

Here are products to help you with due diligence:

BATTLE-TESTED RECOMMENDATIONS

The Course On Website Flipping

Digest a decade of experience in a single day with this jam-packed course covering concepts of buying and selling websites. 6+ hours of actionable video content showing you how to achieve 6-figure exits!

My video lessons cover hands-on due diligence, valuations, finding sites, positioning sites for sale, and much more. Get $100 OFF today!

EasyDiligence.io – DIY Due Diligence

Website due diligence is the #1 challenge for niche site creators/investors when looking to buy a site. I put together a Due Diligence Dashboard which analyzes traffic metrics to flag highlights and setbacks about the site. In addition, you get a 45+ due diligence questions database that includes insights, video walkthroughs, and more. Get $100 OFF!

WebAcquisition – Hire Due Diligence Experts

My team and I of M&A experts have over 50+ years of combined experience performing due diligence on content websites. Our due diligence process reviews 22+ critical points of each acquisition to catch red flags. Our goal is to provide unbiased expertise to help you acquire your next online business. Hire my team today!

Revisions & Changes Made To This Article

Here are the revisions and changes we’ve made to this article over time:

- October 26, 2023: added content quality to the due diligence framework. With the advent of AI, it’s critical to understand if the content is written by an expert or written by AIl; their is nothing wrong with buying AI-based content websites but you should understand if a site is AI vs human-written content.

Keep Practicing Due Diligence!

Due diligence is a must if you are looking to buy a website. Sellers in their best interest will be pushing for a quick sale. Do not fall into that trap. Take your time to make sure you do the proper research.

With that though, it’s a seller’s market, so you may have competition. Make sure to practice due diligence on other deals beforehand so that you are ready to move reasonably quickly.

For example, for sites under $100,000 valuations, you can expect them to sell within a week. For sites less than $30,000, they can sell within 24-hours after the site hits the market. After performing due diligence, make sure to read the guide on how to perform website valuations.

Expertise in website investing due diligence sets apart the beginner investor from the expert. It also protects your hard-earned money from bad deals!